EVs, markets, & sustainable road transport🍋

EVs offer a remarkable example of how markets can solve environmental & affordability challenges, at scale

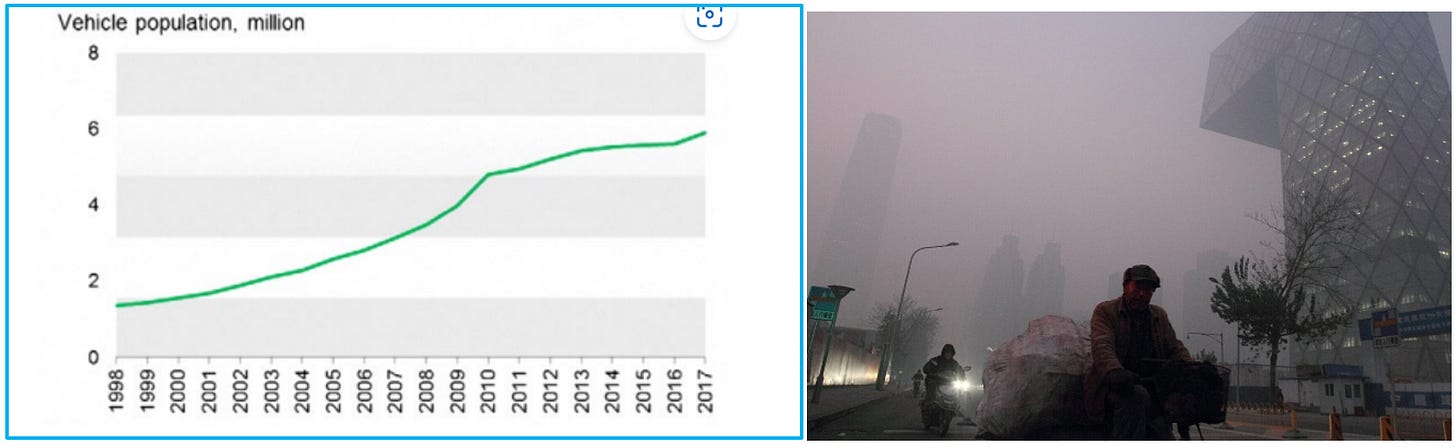

Road transport is beset by problems. Pollution has reached unacceptable levels in many large cities, especially in China. If residents are to have a reasonable quality of life, reduced emissions from transport and electricity generation are necessary. A warming climate and severe weather events caused by rising CO2 levels are creating economic and environmental challenges in many countries. And the high cost and reliability of supply of liquid fuels has been an issue for some time.1

Electric vehicles (EVs) and renewable electricity generation seem ideal technologies to address these problems. In this post, I explore some major developments that have brought these technologies to market, in so making a meaningful and increasing contribution to the goal of sustainable road transport.

Early EVs didn’t make the grade

EVs, operating on lead-acid batteries, have been around for over a century. In recent times their use was largely restricted to golf carts. To be usable and affordable, EVs required a cheap and safe battery. Lithium-ion (Li-ion) batteries, scaled up from their earlier applications in consumer electronics, fit this bill.

Affordable EVs

EVs are starting to come to market with a lower or similar cost of ownership to their fossil-fuelled equivalents. They are increasingly affordable for middle-income consumers.

This was a dream 10-20 years ago, but it is close to reality now. As with any market evolution, the transition towards EVs has been a bit tortuous. The sector is currently experiencing a shake-out as Chinese manufacturers make their presence felt. In my opinion, the future will favour suppliers who have a more affordable practical solution. So the market outcomes for household names such as Toyota and Tesla are uncertain.

Green electricity

EVs, however, are only half the story. An EV built with, and powered by, electricity generated with coal is no better for the climate than a vehicle powered directly by fossil fuels.2 Economically competitive wind and solar generation has provided renewables that can meet the growing demand for EV charging, and substitute for fossil fuels.

EVs require renewable (“green”) electricity to solve the sustainability problem. In recent times the increased availability of low-cost wind and solar generation for both domestic and commercial applications has led to significant shifts in renewable capacity in many economies. For example, renewables contributed more than fossil fuels to UK electricity generation in 2023; and 32% of Australia’s electricity generation in 2022.

The advent of low-cost solar cells from China, and large efficient windmills from Europe, especially in offshore applications, has changed the economics of renewables.

New Zealand has always had a substantial proportion of renewables in its generation mix. Growth in on-shore wind is increasing that proportion. The Energy Efficiency & Conservation Authority (EECA) estimates that 20% additional generation will be needed to meet New Zealand’s EV needs.3 That level of expansion is well within historic growth patterns and, provided the majority of EV charging can be done off-peak, then the existing transmission grid and local distribution assets are likely to suffice.

The lithium-ion battery

The market success of an EV model depends on the cost and performance of its battery. The Li-ion battery, and especially its iron-phosphate variant, has been the enabler for progress in this market to date. Li-ion batteries were first introduced in 1991; since then their volumetric energy density has increased threefold while their cost has dropped tenfold.

Today investment, arguably much of it speculative, is being targeted at solid-state battery development. Solid-state batteries are claimed to be safe and cheap; with rapid charging and energy densities that could transform the EV market. As with any speculative high-stakes high-rewards period of market development, one might hope for a more orderly allocation of resources. Individual firms competing to produce technological breakthroughs is the path the market has taken, primarily in the US and EU. Chinese manufacturers have organised themselves differently, as I’ll outline below.

Motivated manufacturers

China has significantly encouraged its EV development path, arguably in response to unacceptable levels of air pollution in Beijing and other major cities.

Pollution controls were introduced in 2014, together with financial incentives for fuel-efficient cars. China has become one of the largest markets for EVs, coinciding with the development of China’s manufacturing and engineering genius. China is now a producer and exporter of technically advanced vehicles.

Some argue that it was investment by Warren Buffet and Berkshire Hathaway in the Chinese EV manufacturer Build Your Dreams (BYD) in 2008 that set the scene for EVs, and those from BYD in particular, to start to dominate the market. Berkshire Hathaway has called the CEO of BYD “extraordinary", the automaker as a "miracle," and its leader a manufacturing genius who's "better at actually making things" than Tesla CEO Elon Musk. And Berkshire Hathaway is not given to superlatives.4

BYD has perfected the iron-phosphate Li-ion blade battery as the current chemistry of choice for a safe and affordable EV battery. Along with Contemporary Amperex Technology Co., Limited (CATL, another Chinese battery maker) they supply over 50% of the global market. In 2024, BYD, CATL and other Chinese manufacturers joined forces to develop an All-Solid-State Battery Collaborative Innovation Platform. They will compete with the likes of Toyota who have 1,300 patents in the area, versus the 100 or so patents held by Chinese manufacturers.5

BYD started its EV journey by manufacturing electric buses for China’s polluted cities. They originally used lithium iron phosphate batteries because these were cheap and safe; being bulky did not matter for a bus. BYD refined this chemistry, keeping its advantages and addressing its disadvantages, to create the EV battery of choice for today. While lithium iron phosphate batteries are not well-suited for high-performance EVs due to their low energy density, being safe and cheap makes them highly competitive in vehicles that meets the needs of the average person.

Toyota and EVs

In contrast to BYD, Toyota has taken a meandering path with EVs. Toyota is renowned for value, durability, and innovation that meets customer needs at a price they can afford. Toyota created a new class of vehicles — battery-electric hybrids — with its Prius. (Sometime back, the ownership of a Prius in the US was a cultural statement.) But Toyota, despite its experience, has been slow to market with full battery-electric vehicles, while others, in particular Tesla, grew market share.

However, as observed in the old Hilux ads starring Barry Crump, appearances can be deceptive. Toyota has deep experience of managing markets. As an example, Signature Class was a Kiwi initiative that “broke the rules” by importing and refurbishing used vehicles. Getting the permission from Japan took some tough talking; the argument to support the customer held sway in the end. Time will tell whether Toyota is making the right calls on the timing and specification of hybrids and EVs, and of its investments in solid-state battery development.

Markets solve problems

The evolution of the EV is a remarkable example of how markets can solve environmental and affordability challenges, at scale. Governments played their part to incentivise development when significant public policy issues were at stake, but markets made it possible to direct resources to solve the problems needed to bring innovative products to market.

Visionaries (e.g. Tesla) and early-adopting consumers have played their part to create the new markets needed. But the sector is now evolving as mass manufacturers in China and elsewhere produce EVs that are (or soon will be) affordable for ordinary people.

By Martin Rosevear

Supply and cost risks have reduced in recent times due to improved oil extraction technologies including fracking.

“In a scenario where you’re running your car completely on coal [powered electricity], the benefits of an EV are marginal, if they exist at all.” From: Hannah Ritchie (2023). Electric cars are better for the climate than petrol or diesel.

Superlatives aside, Berkshire Hathaway have since reduced their investment in BYD, possibly because of geopolitical risk (MarketInsider).

While I don't disagree with the basic thesis that "Markets solve problems", it's kind of interesting that seemingly little weight is given here to the fact that the technology development in this space has benefited immensely from substantial technology public R&D investment over decades via the likes of NASA and NREL in the US and/or, in the case of China, a state-run economy. Perhaps a better conclusion would be "Markets solve problems, but..."