NZAE Member Survey #4 asked three questions about New Zealand monetary policy.

Overall, the majority of respondents:

Disagreed that inflation expectations are well-anchored in the Reserve Bank’s 1-3% target band.

Agreed that a return to fiscal surpluses before 2025 would reduce price inflation, and thus reduce the official cash rate (OCR) increases necessary to limit inflation.

Agreed that employment levels would decline even if 7% inflation was maintained.

I think it is fair to say that, in the opinion of members, NZ’s current bout of inflation is yet to be tamed.

Survey details

The members’ survey was circulated to NZAE members on November 14th and was open until September 18th. Thirty-nine members answered the survey — 73% were male, and 44% held a PhD. 39% work in academia, and 26% in government. A majority (56%) were over 50 years old.

Respondents were also asked to rate their level of confidence in their answers. I used these ratings to weight answers.1 The bar charts and numbers in this post are unweighted. Please email me if you’d like a copy of the weighted results.

Q1 Are inflation expectations well anchored?

Despite current inflation rates, inflation expectations remain well-anchored within the RBNZ's target band of 1-3 percent over the medium term.

The majority of respondents strongly disagreed (34%) or disagreed (37%) with this statement. Only 13% agreed, with 16% uncertain.

Females more often answered “strongly disagree” or “disagree” than did males.2

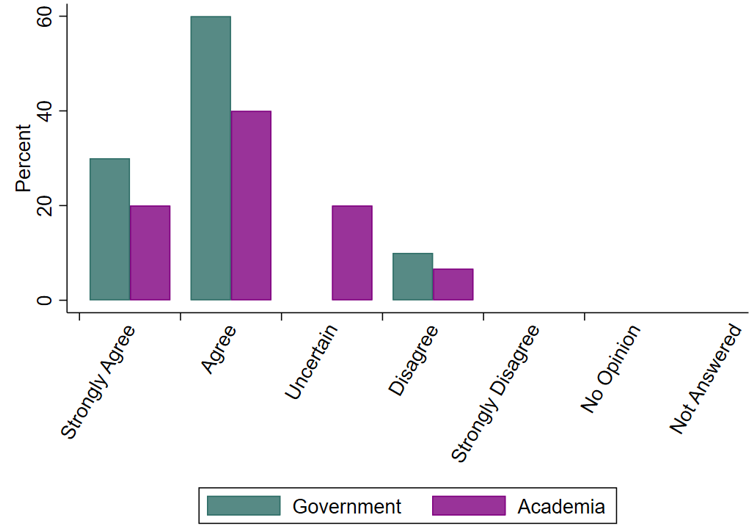

A divergence between government and academia?

Interestingly, respondents in academia diverged from those in government employment. Those in academia were much more likely to strongly disagree compared to those in government work, who were much more likely to agree or be uncertain.

Q2 Do fiscal surpluses reduce inflationary pressures?

The 2022 Budget Economic and Fiscal Update projected a government OBEGAL deficit of 5.2% of GDP in 2022 and 1.7% of GDP in 2023, with surpluses returning from 2025. A faster return to fiscal surpluses would ease pressure on prices, so smaller increases in the OCR would be needed to return inflation to the target.

Most respondents agreed (47%) or strongly agreed (29%). Only 9% disagreed.

Females were more likely to agree or strongly agree than males, though the differences were small.3 Similarly, government employees were more likely to agree or strongly agree, while respondents from academia were more likely to be uncertain.4

Q3 Does higher inflation support higher employment?

While there are trade-offs between inflation and unemployment in the short term, employment levels in the longer term are determined by structural features of the economy. Employment rates will decline from current peaks even if inflation were maintained at 7% over the longer term.

The majority of respondents agreed (36%) or strongly agreed (33%) with this statement. Only 7.6% disagreed or strongly disagreed, while 23% were uncertain.

Males were more likely to agree or strongly agree than were females.5 Respondents from academia were more likely to strongly agree, while government employees were more likely to agree or be uncertain.6

This survey was the last 2022. The next one should hit member’s inboxes in February 2023. Please get in touch if you’d like to suggest some questions.

See my post on member survey #3 for details on the weighting system.