Members disagree on fiscal stimulus via lower taxes in Budget 2024🍋

Though most members surveyed agreed that reductions in current income taxes could shift the burden of government expenditures to future taxpayers

The tenth NZAE member survey asked questions inspired by the fiscal circumstances surrounding New Zealand’s Budget 2024, which is expected to be released on 30 May.

We polled NZAE members for their opinions on income tax, fiscal stimulus, and the relationship between them. The background context for the questions is that the government’s finances are currently in structural deficit, which the OECD defines as:

A structural budget deficit is … that excess of public spending over revenues which would persist if the economy were to grow steadily at its highest sustainable employment rate, i.e. at the same rate as potential output.1

The survey

We circulated the survey amongst NZAE members on Monday 29 April 2024 via Asymmetric Information. Responses were open for one week. Forty-eight respondents answered the survey. 79% of respondents were male, and 38% held a PhD. Most respondents work in academia or in the government (62%). The 41-50 age group was best represented (31%).2

The tax burden of government expenditure

Q1. When the overall budget is in structural deficit, for any given level of government expenditure, reductions in current income taxes shift the burden of current government expenditures to future taxpayers – either through higher tax collections in future than would otherwise be the case, lower expenditure, or both.

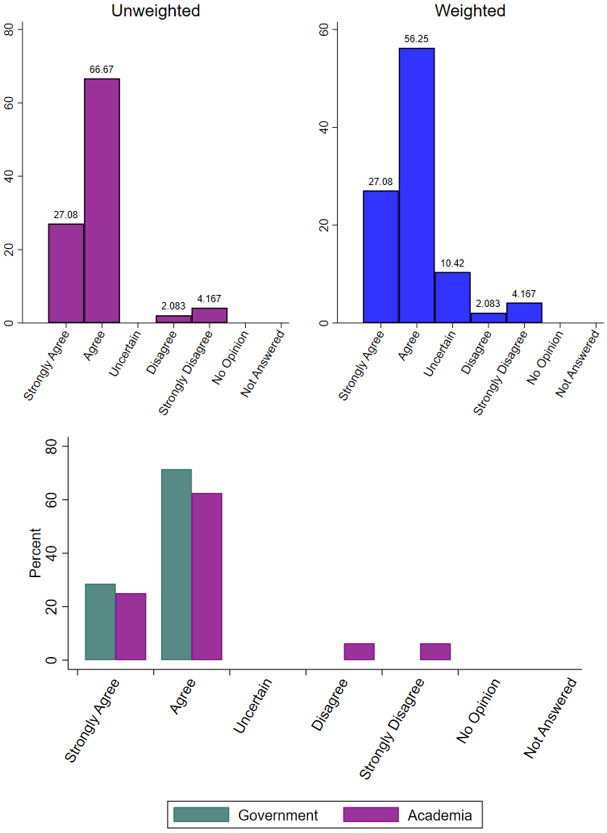

The majority (83%) of respondents either agreed or strongly agreed. There was little difference between respondents working in academia vs. those in government.3

Income tax cuts in the presence of structural budget deficits

Q2. Holding government expenditure constant, reductions in income tax rates when the budget is in structural deficit are reasonably characterised as fiscal stimulus.

Again, almost all respondents agreed or strongly agreed. Some (13%) were uncertain. I find little difference between respondents in academia and those in government; at best academic respondents are somewhat less likely to strongly agree.4

The upcoming Budget 2024

Q3. Fiscal stimulus through income tax reduction is, on balance, warranted in Budget 2024, even if the budget remains in structural deficit.

Here, we find some disagreement. About 28% of respondents agree or strongly agree, while the majority (about 58%) disagree or strongly disagree. Respondents in academia are more likely to agree/strongly agree while government economists are almost entirely disagreeing/strongly disagreeing.5

In summary

Overall, the tenth NZAE Member Survey reveals that while most respondents agree that reductions in current income taxes could shift the burden of government expenditures to future taxpayers, there is significant disagreement regarding whether fiscal stimulus through income tax reduction is warranted in Budget 2024.

Weighting

The survey also elicits the confidence in the answer to each of the three questions. This information can be used to weight the responses. I present the unweighted (raw) and weighted survey responses below.6 The results reported above are unweighted, unless otherwise specified. We found little divergence between the weighted and unweighted results for the questions in this survey.

A big thank you to the members who participate in our surveys. Visit the Surveys section of the Asymmetric Information website for the results of all of our member surveys.

Muller, P. & R. Price (1984), "Structural Budget Deficits and Fiscal Stance", OECD Economics Department Working Papers, No. 15, OECD Publishing, Paris, https://doi.org/10.1787/050184860264.

Without an optimal weighting approach, we weight the survey responses as follows. We first compute the mean confidence for each question. Then, for each respondent, we compute the absolute distance from the confidence mean, weighted by the confidence standard deviation. If the response is above (below) the midpoint (i.e. disagree and strongly disagree) and the confidence is above mean confidence, we add (subtract) the weighting factor. If the response is above (below) the midpoint (i.e. disagree and strongly disagree) and the confidence is below mean confidence, we subtract (add) the weighting factor. We also multiply this weighting factor by the number 0.49 to smooth the overall weighting effect.

Hi

Great series of surveys, well done. I'd like to suggest one small improvement in the write-up: let's see a description of how the 'other' (I'd guess largely/completely private sector) group voted, and not just the academic/government split. After all, those of us in the 'other' group are actually the largest sub-category

Best wishes

Donal Curtin